FactSet: From Quality-at-Any-Price to Moat-at-a-Reasonable-Price

Why an AI panic and a growth scare may have created a durable compounder on sale

Overview

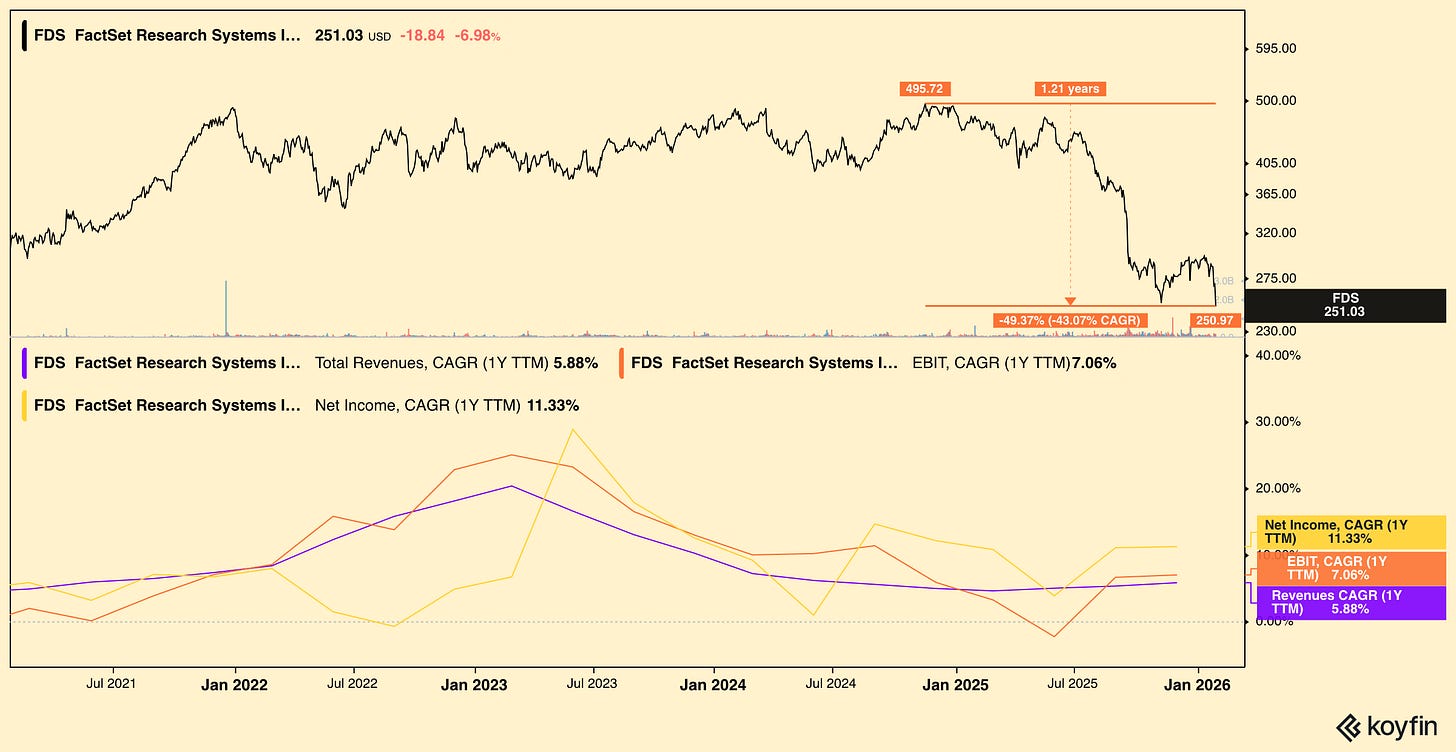

FactSet (FDS) is a high‑quality, wide‑moat financial data and analytics platform that has just gone through a brutal re‑rating. From a peak near $500, the stock has fallen 50%, compressing its multiple from a quality-at-any-price premium into not quite a GARP play, because growth is lacking, but more like a MARP (moat-at-a-reasonable-price) stock. Against that, the underlying business still exhibits classic compounder traits: sticky subscription revenue, mission‑critical workflows, high margins, and a long operating history.

When something like this happens, the investment question is no longer

“Is FactSet a great business?”

It is “Is this still a high‑quality grower, or is it maturing into a mid‑single‑digit, ex‑growth, utility‑like data vendor that deserves a lower multiple?”

Your answer to that will determine whether today’s valuation is a bargain or a value trap. What follows is my humble take.

The Business

FactSet is a global financial data and analytics provider. Its core offering is an integrated platform delivering:

Market data (equities, fixed income, derivatives, FX, etc.)

Fundamental and estimates data on companies, sectors, and funds

Portfolio analytics and performance attribution tools

Risk analytics, scenario analysis, and stress testing

Research workflows, screening, and modeling environments

Industry and sector analysis tools

The company serves the usual suspects:

Buy‑side: asset managers, hedge funds, wealth managers

Sell‑side: investment banks, research boutiques, brokers

Corporates and other institutions

Revenue is overwhelmingly subscription‑based. FactSet reports Annual Subscription Value (ASV) plus professional services as its core economic engine, which reached roughly $2.1b in recent years. There are several good things about FactSet’s revenue. It is usually contracted on annual or multi‑year terms, billed per seat, and embedded into critical workflows.

Client retention is consistently above 90%, often cited in the 90–92% range, with average relationship length above a decade. That combination – high retention, long tenure, and daily usage – signals deep integration and high switching costs.

The nature of demand is very robust. Analysts, portfolio managers, and traders live in these tools. The data feeds are integral to how portfolios are constructed, monitored, and reported. Cutting a platform like FactSet introduces operational risk, retraining cost, and process disruption.

This is not a piece of nice‑to‑have software that can be turned off in a bad quarter. Even when budgets tighten, firms are more likely to negotiate prices or reduce seats than completely shut down the service. Switching to a new provider is disruptive, risky, and costly. Of course, this has its downside when you are the smallest of the pack.

The Competition

At the platform level, FactSet competes with a handful of global heavyweights:

Bloomberg: The gold‑standard terminal plus massive enterprise data business.

LSEG/Refinitiv (Eikon): Second‑largest terminal/data vendor, now inside London Stock Exchange Group.

S&P Global Market Intelligence / Capital IQ: Deep fundamental and credit data, research, and analytics.

FactSet’s differentiation is less about raw breadth of data, where the offerings are more or less similar, and more about the tightly integrated workflows for equity/fixed income research and portfolio management, combined with strong portfolio analytics and performance tools. Lately, increasing AI‑enabled features, such as FactSet Mercury and natural language interfaces, are the focus of both the market and FactSet’s customers.

Said another way, FactSet’s differentiation is less “best terminal UI” and more “best integrated data + analytics + workflow stack you can deploy across teams and systems.” The company focuses on interoperability and modularity. It gives clients the ability to mix and match data feeds, analytics, workstation apps, APIs, and so on to fit their individual use cases. A core differentiator is making data/analytics available via integrations and tooling that can plug into internal systems and processes.

FactSet also places emphasis on supporting recurring workflows like market monitoring, company research, screening, portfolio analysis, reporting, and risk‑related tasks. You can imagine how these workflows are being revised as we speak to incorporate AI, but more about this later.

Market Share

Estimates differ slightly by source and by whether you draw the boundary around “terminals,” “market data,” or “financial data and analytics,” but it is roughly something like this:

Bloomberg: ~33–36%

Refinitiv: ~19–20%

CapIQ: ~6%

FactSet: ~4–5%

For better or worse, FactSet’s share has remained quite stable over time. This links back to the stickiness of the business, which is a boon for #1 and a bane for #4. From a moat perspective, maintaining share in an increasingly competitive, AI‑disrupted environment is itself a sign of resilience. But from a growth investor’s perspective, the absence of share gains dampens the upside story.

Financials

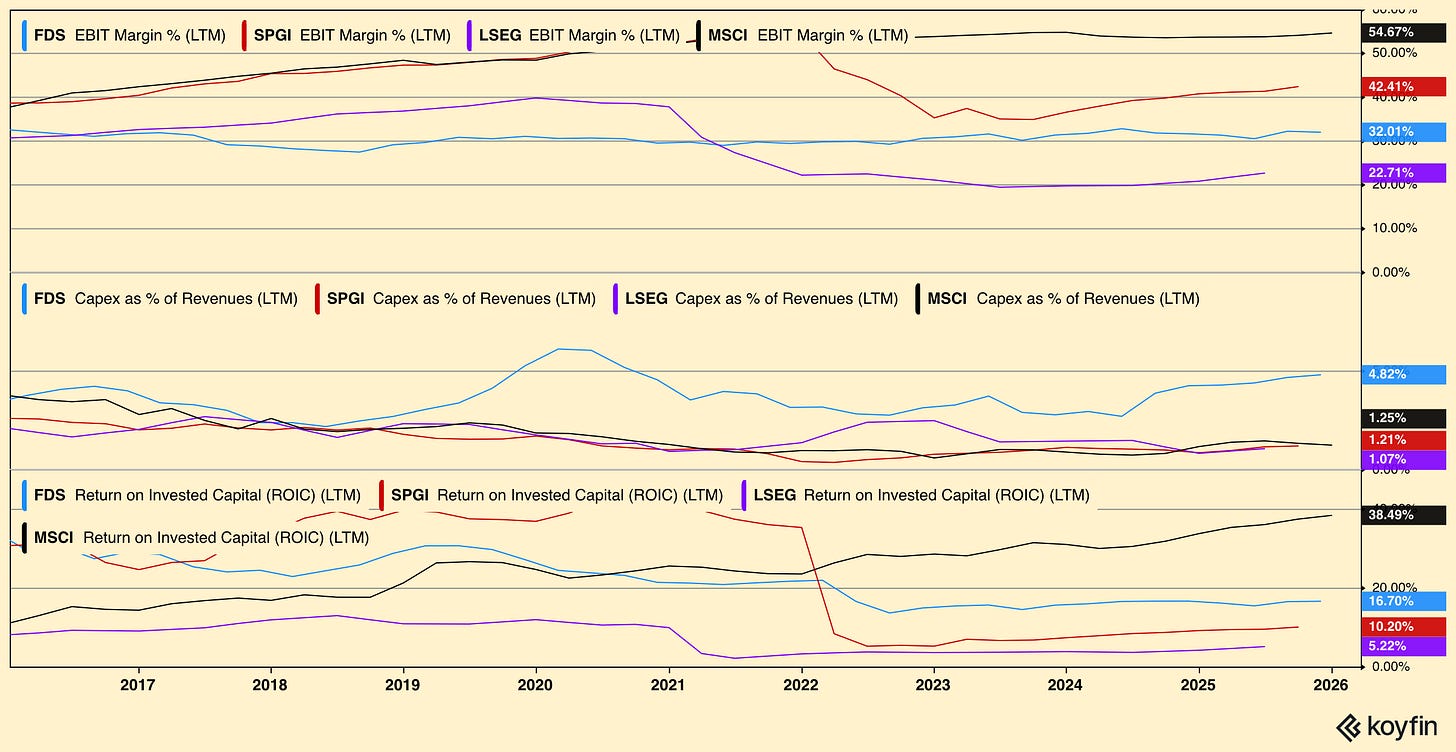

FactSet exhibits classic data/software economics – high margins, capital‑light, high ROIC.

The available comparables are not ideal, but that’s what we have. FactSet’s EBIT margin is not the best, but it is the most stable in the group. Its capex as a percentage of revenue, albeit low, is the highest in the group, but you have to take into account that FactSet’s core business is a software platform that requires more maintenance and development investment compared to the rest of the group.

ROIC seems to have plateaued under 20% after 2022, and it is not clear whether the company has a way of bringing it back up to 20%. The 16% level as of late, while not exciting, provides a decent return on top of the cost of capital.

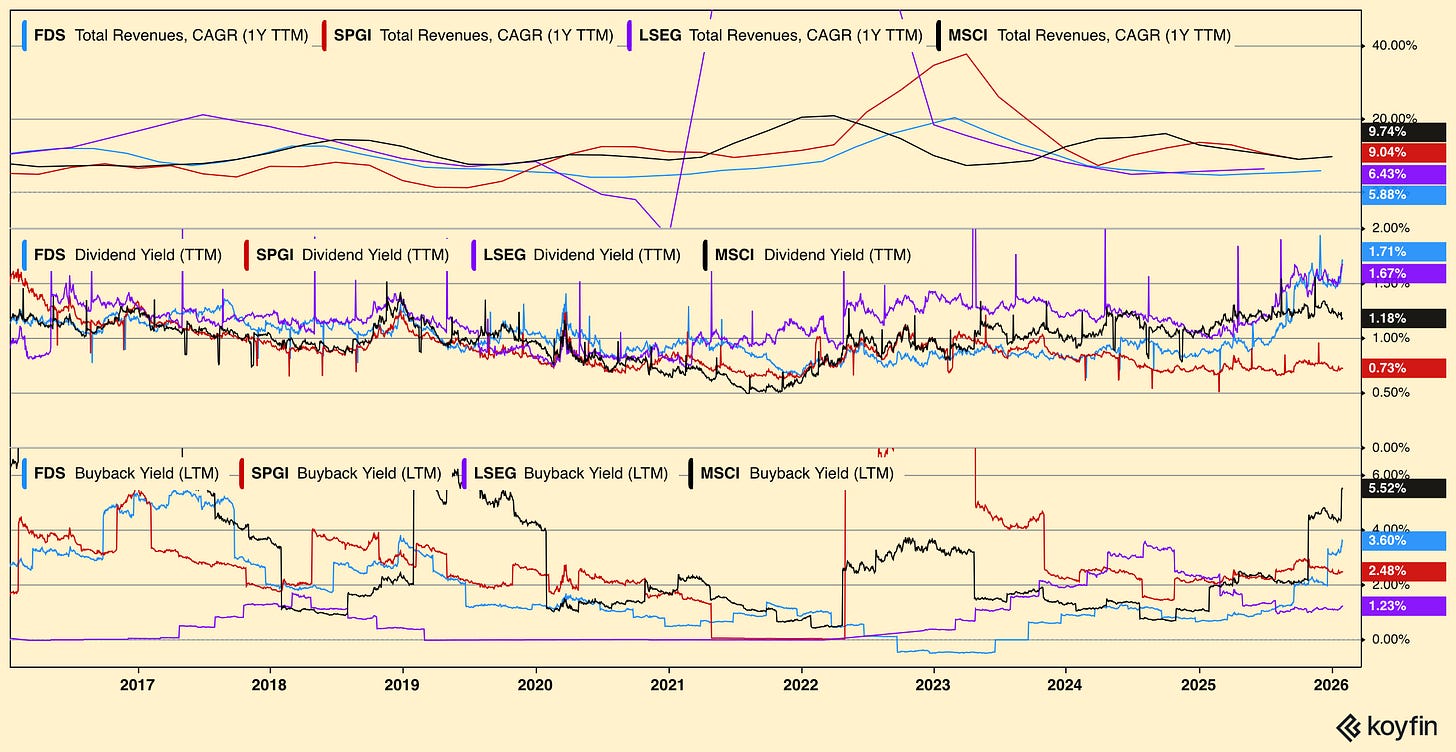

Revenue growth is the big damper on the stock price. It has slowed down to 5–6%. The fear is that AI is eating FactSet seats.

In the past, growth was driven by increasing seat counts and deeper penetration with existing clients, new modules, and small bolt‑on acquisitions of niche datasets or analytics vendors. Today, FactSet is experiencing cost‑cutting at its client base, who choose to reduce seats and experiment with AI. It will take some time for this trend to play out. However, in the end, I see two things happening. First, FactSet’s customers will realize that there is no substitute for quality data. Second, FactSet will develop agentic AI functionality on its platform. The result would be a re‑rating in the opposite direction.

The mix of dividends and opportunistic repurchases supported by recurring cash flows will be the main driver of unlocking value in the near term. The long haul will be determined by the return to growth and the successful navigation of the AI landscape.

On the balance sheet side, FactSet carries some debt, largely linked to acquisitions, but leverage is moderate and manageable. Free cash flow is robust and supports dividends and buybacks.

Capital allocation has historically been disciplined: tuck‑in acquisitions to expand data coverage and analytics capabilities, combined with ongoing investment in R&D and content.

Key Issues

Mr Market did not de‑rate FactSet for no good reason, as he often does. Here are the major contributors to his change of mood.

Growth

The growth story became more complicated. ASV growth is now guided in the mid‑single digits (4–6%), below the pace implied by prior premium valuations. Q4 2025 EPS missed estimates while delivering only a modest revenue beat, triggering a 6%+ drop on the day. Forward guidance came across as cautious, with stronger emphasis on competition and cost pressures.

AI

On AI specifically, FactSet is positioning itself as a provider of AI‑enhanced workflows. It is also a data provider into third‑party AI models and client‑side applications through APIs.

The big scare right now is that AI‑native platforms might compress the value of legacy players like FactSet. Mr Market re‑rated anything that looked like “old guard” data without a crisp AI monetization story. Analysts are increasingly stressing AI‑related disruption risk, cheaper rivals, and a perception that FactSet is trailing rather than leading on AI.

AI has lowered the barrier for everyone who wants to become a developer. As a consequence, investors are asking the very reasonable question of whether clients could assemble similar functionality from APIs plus LLMs at lower cost, compressing FactSet’s pricing.

Moreover, higher investment in AI and tech, increased data/content costs, and real‑estate/people inflation have pressed operating margins even as revenue rises.

Recent Developments (Q1 2026 and Q3 & Q4 2025)

Three topics emerge from the last three quarterly calls:

leadership transition

AI focus

market share gains

In Q3 2025, Phil Snow announced his retirement after 30 years, with Sanoke Viswanathan taking the helm in September 2025 (Q4 2025). Viswanathan’s mandate is to position FactSet as a leading AI‑powered intelligence platform, focusing on enterprise solutions that lower the total cost of ownership for clients. To sharpen this focus, FactSet divested RMS Partners, a non‑core sell‑side platform, to reallocate resources toward high‑growth areas like content and technology innovation.

Management claims that AI has moved from an internal productivity tool to a primary driver of financial performance. By Q4 2025, AI investments were responsible for approximately two‑thirds of FactSet’s organic ASV growth acceleration. By Q1 2026, AI product adoption grew 45% sequentially. To be fair, it is not entirely clear how this improvement came about and what exactly it measures.

“Just in the past 30 days, our clients have actively used 1 million custom models and screens to run data queries pulling hundreds of billions of data points. We believe AI will accelerate this flywheel. We are still in the early stages of enterprise AI adoption. But to give you an example, across the AI products we launched earlier this year, we’ve seen broad‑based user adoption with sequential growth of more than 45%. Put simply, AI doesn’t replace what makes FactSet essential, it amplifies it.”

– Sanoke Viswanathan, CEO, Q1 2026 Earnings Call on 2025‑12‑18

The focus on AI will drive capital investment. CFO Helen Shan is planning to mitigate the margin impact (‑1.5% FY26 guidance) of the investment program by reducing headcount and services spend, and by relying on AI to improve efficiency.

“To help fund these activities, we are executing on productivity actions Sanoke noted earlier, reallocating resources from maintenance to growth initiatives, managing headcount and third‑party spend more rigorously and implementing AI to automate routine processes. Together, these actions should produce sustainable expense savings. On capital allocation, we maintain a balanced framework. But in our priorities, growth comes first. We are deploying capital into product development, go‑to‑market capabilities and infrastructure modernization to drive future growth.”

– Helen Shan, CFO, Q1 2026 Earnings Call on 2025‑12‑18

On the thorny issue of AI driving reductions in headcount, and respectively seats, at FactSet’s customers:

“We are not seeing yet any real reduction in headcount, frankly, not even in banking, where there has been a significant amount of discussion about it.

What we are actually seeing this season is a strong recovery, driven by the M&A recovery more broadly. We’re actually seeing increased headcount, increased hiring of bankers. And by the way, increased usage of all of the digital tooling, including our AI products. So our banking AI products, for instance, have seen over 100% in terms of usage growth just quarter‑on‑quarter. So I actually think what is really likely to play out is that we are going to see consumption growth, which we are very well prepared for because of the way in which we are striking our contracts with clients and an increase in headcount as well.”

– Sanoke Viswanathan, CEO, Q1 2026 Earnings Call on 2025‑12‑18

Overall, demand for data is growing as it is consumed in more ways and integrated into more processes.

“There’s lots of demand for new data products. There’s expansion in the ways in which clients are looking at consuming our data and applying it to work. So we’re seeing growing demand from the technology offices of clients, data science teams. So teams that were traditionally not perhaps in front of a FactSet Workstation, but are starting to consume our data in significant quantities across new channels whether it is APIs, direct data feeds, cloud connectors, MCP servers, et cetera.”

– Sanoke Viswanathan, CEO, Q1 2026 Earnings Call on 2025‑12‑18

Valuation

Price: $250

Trailing EPS: $15.87

Trailing P/E: 16x

Market cap: $9.4b

Dividend yield: ~2%

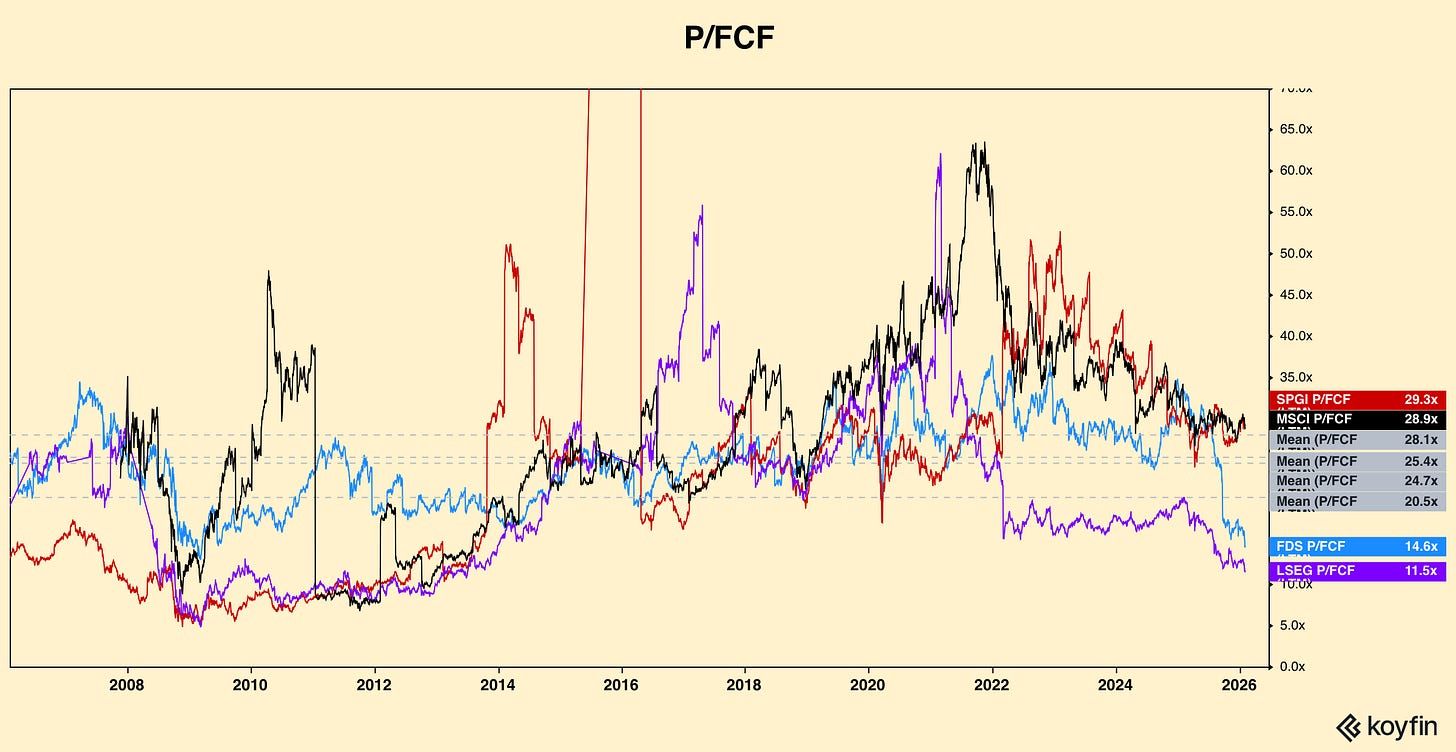

FactSet has typically been a premium stock, often in the mid‑20s to low‑30s P/E in recent cycles. Mid‑teens P/E is closer to a dull industrial or low‑growth consumer name than a high‑margin, high‑ROIC data vendor.

SPGI, MSCI, and other top‑tier data/analytics franchises often trade in the mid‑20s or higher P/E multiples when growth is high single digit or better.

On a simple relative basis, FactSet now looks cheap versus both its own history and its closest quality peers.

Now, to get an idea about the rough intrinsic value of the business, I will make the following assumptions:

revenue growth stabilizes at 4–6% per year (ASV growth range)

margins roughly hold, with some AI/content cost headwinds offset by operating leverage

add a 2% dividend yield and modest buybacks retiring, say, 1–2% of shares annually

That gives you a plausible high‑single‑digit to ~10%+ annual total return if the multiple stays flat.

Should the multiple stay flat? What if Mr Market eventually decides FactSet is still a high‑quality, durable financial intelligence platform? Look at the multiples of the group. SPGI and MSCI are trading at around 30x now, and their historical means are 25x and 28x. FactSet’s own mean is 25x and it is currently trading below 15x. Reverting to the mean over the next 5 years would add 10% to total shareholder return, which we estimated conservatively at 10%.

The worst‑case scenario is that growth slows further and AI eats up some of FactSet’s lunch. In this case, the current mid‑teens multiple will be deserved and the stock price will stagnate or drift lower. Certainly, while AI is at peak hype, the downside volatility can be significant. Absent a clear AI value‑capture story, the stock may languish in value purgatory.

The current multiples are implying:

Growth and pricing power are impaired

AI risks are non‑trivial and FactSet will not catch up

Clients will aggressively rationalize costs

FactSet is not a premium data and software company anymore

I would argue against each of these points. For me, FactSet at 16 times earnings is an opportunity to buy a high‑quality oligopolistic data franchise at a price that bakes in a lot of pessimism.

I will be watching how ASV develops — whether it meets my expectations of stabilizing at 4–6% or drifts lower. Over the next few quarters, I will be listening to earnings calls for commentary around renewals, seat reductions, pricing, and margins, and of course, AI features adoption.

Conclusion

FactSet remains a high‑moat, durable business whose economics are better than its current multiple suggests. However, growth has slowed, competition is intensifying, and AI is structurally raising the bar. The current multiples offer an opportunity to generate 10–20% total return for shareholders over the next 5–10 years. This opportunity exists because of AI.

Right now, the “quality compounder” narrative — based on high margins, predictable subscription revenue, and an oligopolistic market — has been busted. However, narratives change.