Annual Review 2025

Four Big Ideas, One Wild Year, and the Case for Stock Picking

I am happy to greet you all and pat myself on the back for making it through one more crazy year. I am grateful to all of you who stayed with or joined this publication despite its flaws. My highest hope is that I brought something of value to your attention in 2025. The posting frequency is embarrassing, even by the low bar I set at the beginning. Instead of two posts per month, I published roughly one every two months.

I have a solid excuse that I am sure nobody cares about. I spent months trying out AI models and agents, integrating them into every imaginable workflow I care about, and starting and completing several side projects with their help. Being the cautiously optimistic type, I had to experiment extensively before making up my mind. By now, it is obvious that AI tools are here to stay, and we have to do what people have been doing since the dawn of time — adapt or die.

I don’t mean this in the fatalistic tone of some AI experts who warn that singularity is here, AGI is around the corner, and we won’t even be good as batteries. What I mean is that we have to adapt in a very practical sense — to make use of the new tool we’ve just discovered. It is a type of technology with such broad application that it’s impossible to predict the second-, third-, and higher-order effects that will reverberate through our timeline.

What I am trying to say with this long detour of an excuse is this: learn to use AI and use it well. Just like the internet before it, you can use it for creative pursuits that were unimaginable not long ago. Or you can use it to waste time, get depressed, and wreck your life. At least we still have some good options — although, judging by the way global events are moving, it feels like those options are narrowing.

Let’s get back on track. I wanted to do a quick recap of the meagre postings on this Substack in 2025. I shared precisely four actionable ideas across six posts. As luck would have it, they were mostly good. More importantly, I enjoyed every minute of the research that went into these posts — all 5,160 of them. That’s 86 hours, or about 20 hours per post on average, which aligns with my long-term average.

I like collecting stats, and they say I normally spend about 20 hours over a week or two when researching a new idea. Updates take a quarter or a third of that time. I tend to focus on posting new ideas here, hoping that this way I deliver more value to you. I do follow-up posts when there are major events related to the original idea. This may be counterproductive for reader satisfaction.

As David at Scuttleblurb shared in his coolly realistic post about the newsletter business, there are three factors critical for retaining one’s invaluable subscribers:

Frequency: High volume is a "business necessity" to establish habits and provide more conversion opportunities.

Thematic consistency: People subscribe because they think they know what they’ll get; if one week it’s semiconductors, the next it’s macro, and then gardening, the reader base eventually shrugs and tunes out.

The "current thing": Addressing trending topics satisfies the reader’s social incentive to stay informed on popular discussions.

Even before reading his post, I knew I wasn’t doing any of this “right”. As I went through it, I mentally checked all the boxes.

☑︎ My frequency is abysmal.

☑︎ Thematic consistency is non-existent.

☑︎ And I almost never post about current events — except maybe that one piece on The State of AI.

Therein lies the chasm between doing something that’s financially sound and something that’s genuinely enjoyable. Is there some balance — a bridge over this gap — that one finds after many tries? This sub definitely hasn’t found it, but I like to think it exists. It could be wishful thinking, though. We always want a little bit more — to be a bit more efficient, a bit more productive, a bit more profitable. It’s a slippery slope.

This will be my wish for all of you: in the coming year(s), may you find this balance for yourselves — a proportion of joy and pay, so to speak, that is just right for you. The more overlap, the better.

Now, back to that review.

4 ideas

200% average holding-period return

ranging between 30% loss and 500% profit

Obviously, this is a fun stat, but also ridiculous and meaningless unless taken with these caveats:

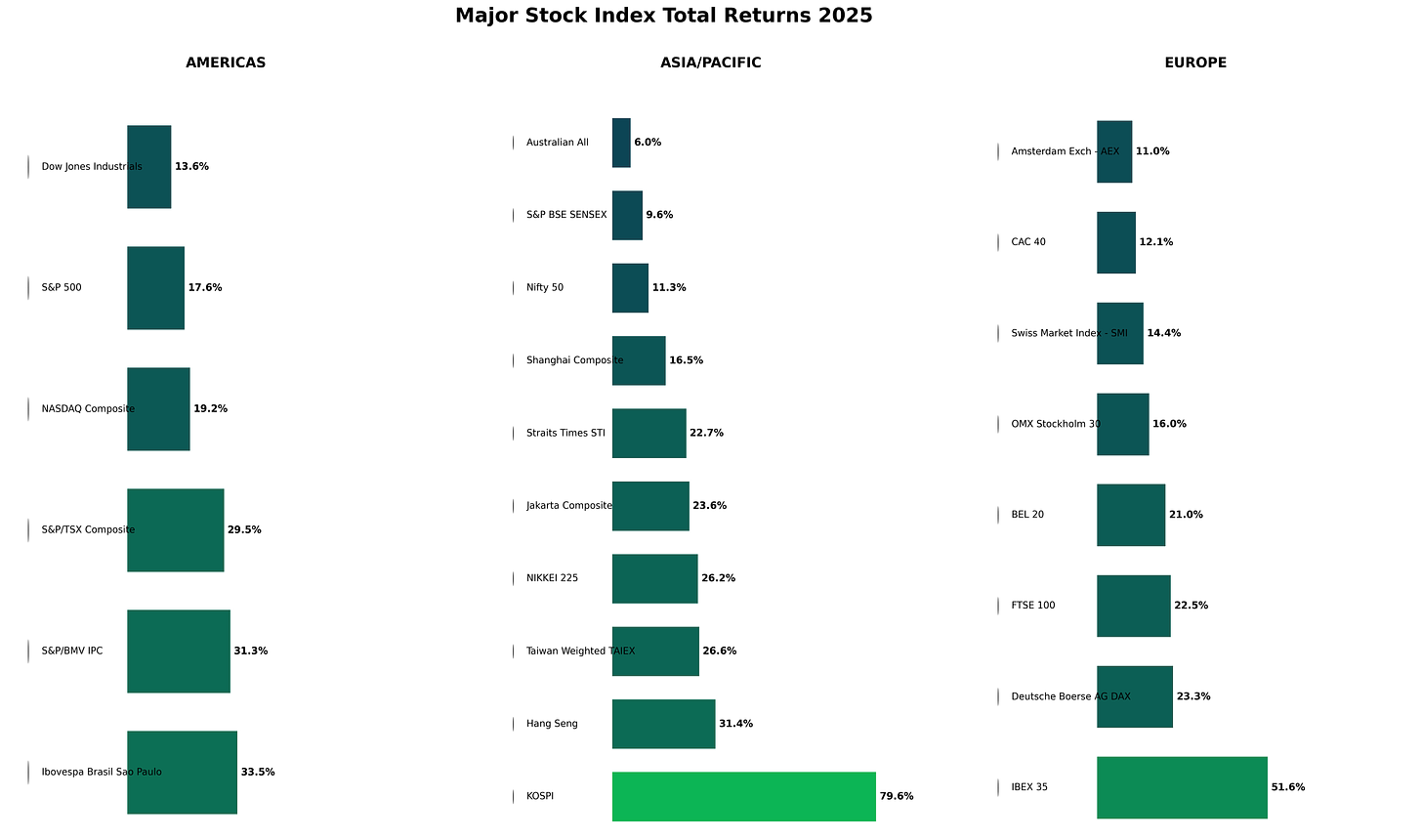

This is not my portfolio return. My portfolio is up about 30%, which this year could have been achieved effortlessly by holding any of the indexes in the chart below. This is a reliable market phenomenon, by the way — every year, there’s a diversified index that trounces my portfolio. This is your annual reminder that beating a diversified index consistently over time is a massive undertaking — and not worth the effort unless you truly enjoy playing detective and spending countless hours learning about different businesses. Maybe not even then.

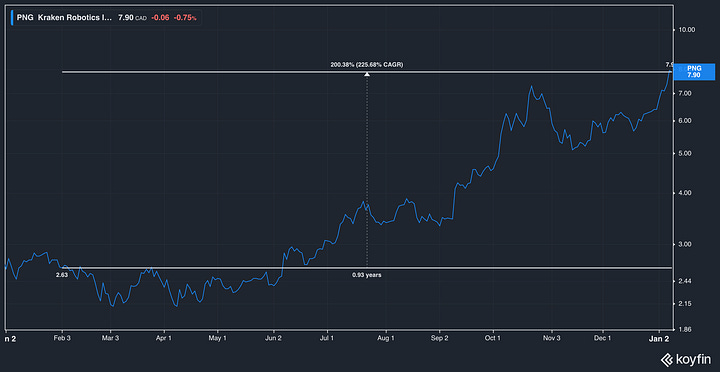

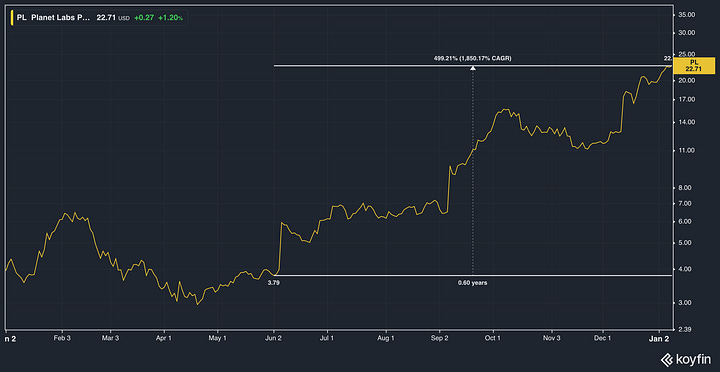

These are not companies I necessarily consider “value” investments (except HII and MBX, maybe). But then again, I never said I’d only write about traditional value ideas. It has been extremely interesting learning about the business models of Kraken Robotics and Planet Labs.

Such returns are a freak occurrence. Picking a handful of such stocks is an even bigger anomaly. This performance is certainly not indicative of future returns. Quite the contrary — the valuations of these companies are now so inflated that any misstep could cause them to implode.

However, with all those caveats in mind, if you got something of value from these posts — whether a stock idea or just a fresh perspective — consider subscribing if you haven’t, and mention it to anyone you think may benefit from some serendipity. Paid subscribers can access the full archive, including the outliers mentioned above.